Ca News

April 25, 2018

Covered California Analysis Shows Major Declines in New Enrollment Nationally and Identifies Policies That Could Lower Premiums in 2019

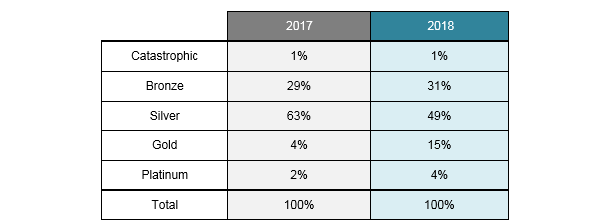

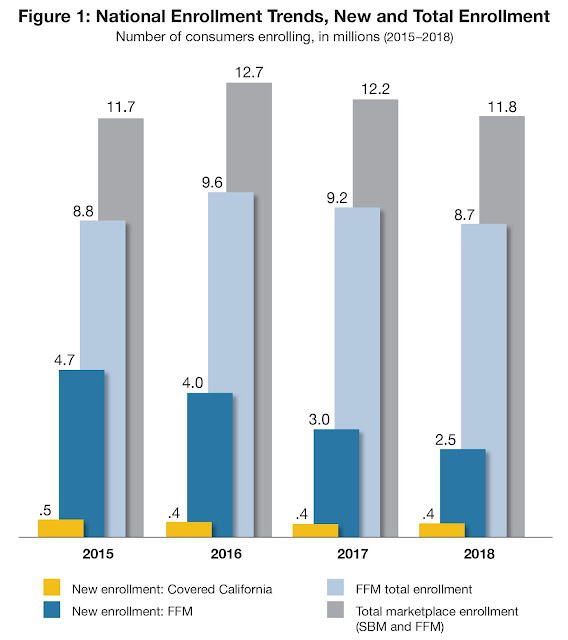

- Enrollment in the federally facilitated marketplace has dropped 9 percent over the past two years, with a nearly 40 percent drop in new enrollment, while enrollment in state-based marketplaces remained steady during the same period.

- Early data on off-exchange enrollment indicates that an additional 1.6 million unsubsidized middle-class Americans also left the off-exchange market over the past two years.

- Increased federal investments in marketing and outreach, from assessments collected for that purpose, could reduce premiums by 3.2 percent from 2019 to 2021 and save Americans $6.6 billion in premiums.

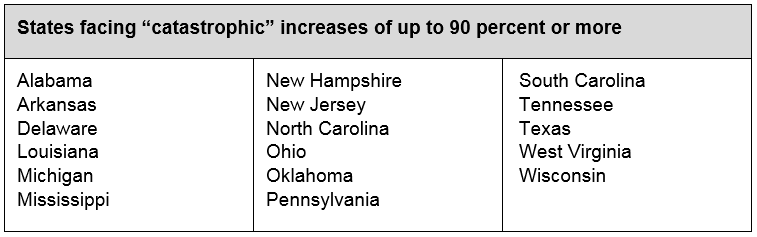

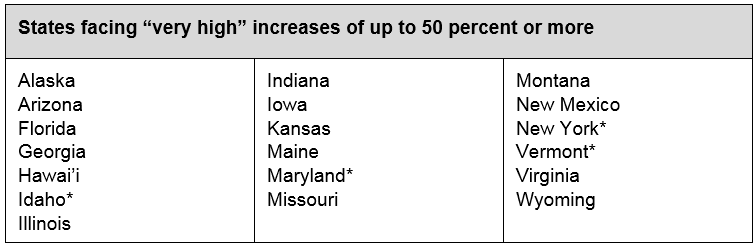

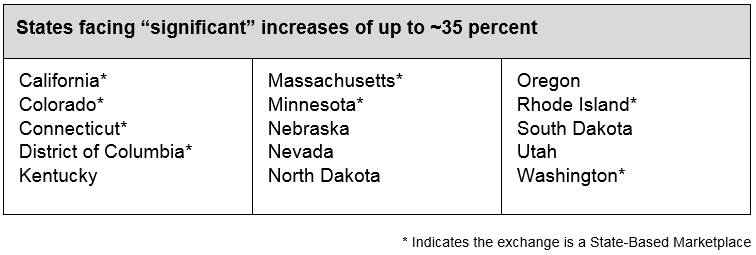

- Failure to act within the next few months will directly contribute to premium increases that could exceed 30 percent in many states in the federal marketplace.

SACRAMENTO, Calif. � A new Covered California analysis finds enrollment in the federally facilitated marketplace (FFM) has dropped 9 percent over the past two years, driven by a nearly 40 percent drop in new enrollees, while the number of consumers signing up for coverage through state-based marketplaces (SBMs) has remained steady over that time.

The report, Individual Insurance Markets: Enrollment Changes in 2018 and Potential Policies That Could Lower Premiums and Stabilize the Markets in 2019, finds that the dramatic decrease in new enrollees in the federal marketplace, which coincides with decisions to pull back on marketing for federal marketplace states, will likely mean a less-healthy consumer pool and higher premiums to cover the sicker enrollees.

�Enrolling new consumers every year is critical to maintaining a healthy consumer pool and keeping premiums low,� said Peter V. Lee, executive director of Covered California. �The drop in new enrollees at the federal level is deeply concerning and can be tied directly to recent policy decisions to not spend resources available to promote enrollment � leading to increased premiums for millions of Americans who do not get federal subsidies.�

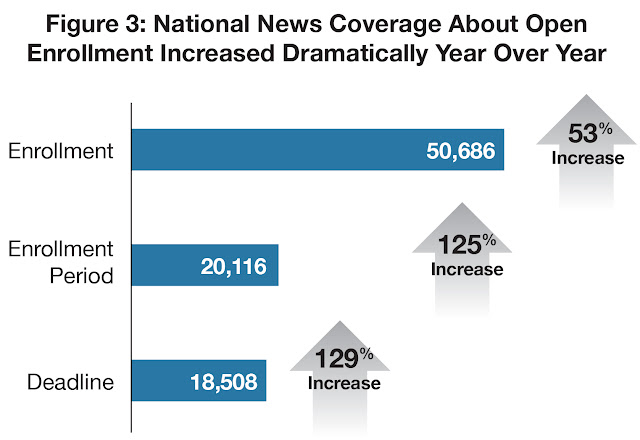

Lee noted that the administration canceled its marketing during the last week of open enrollment in 2017 and then dramatically scaled back its marketing and outreach efforts during the most recent open-enrollment period.

�We are seeing the results of the federal decision to cut marketing by 90 percent: fewer people enrolled, a sicker consumer pool and higher premiums that could leave many � particularly those who do not get any financial help � priced out of coverage,� Lee said. �With health insurance companies making decisions in the coming months about whether to participate in 2019, and what to charge, the time is now to take action to protect millions of consumers from unnecessarily high rates.�

Similar to Covered California, the FFM has collected revenue from its health plan assessment � amounting to $1.2 billion in 2018 � that does not require any appropriation and can be used in a variety of ways. Covered California allocates one-third of its assessment revenue to marketing and outreach, and if FFM did the same, it would invest more than $400 million, which should lower premiums by 2.3 percent in 2019 and save consumers and taxpayers $1.6 billion. Maintaining this investment over three years would lower premiums by an average of 3.2 percent and save an estimated $6.6 billion during that time.

�Insurance needs to be sold, and it does not make any sense to let that money go unused when millions of Americans are at risk of higher premiums,� Lee said. �The administration needs to act like a business and recognize that now is not the time to continue its policy of cutting back on marketing, which will directly result in higher premiums for millions of middle-class Americans.�

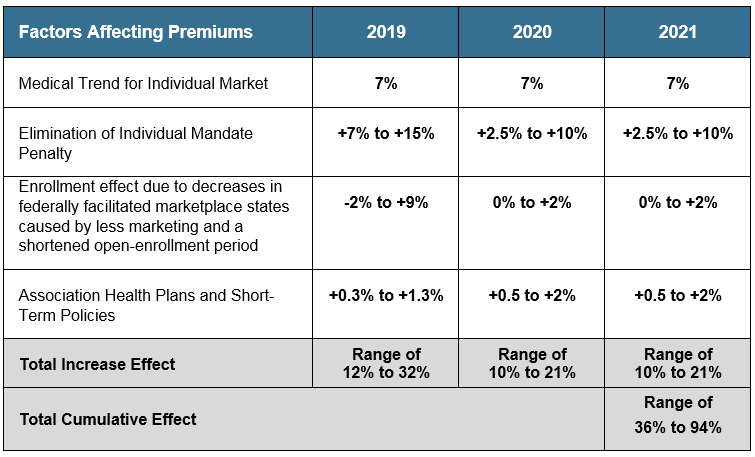

A previous Covered California analysis found that in the absence of Congressional action, premium increases in the individual markets will likely range from 12 to 32 percent in 2019 and cumulative premium increases from 2019 to 2021 will range from 35 percent to more than 90 percent in some states. (Read the full analysis here: https://coveredcanews.blogspot.com/2018/03/national-analysis-projects-2019-premium.html.)

While subsidized consumers would be insulated from premium increases, which would also increase the amount of financial assistance they receive, unsubsidized consumers would bear the full weight of the higher premiums. Covered California previously estimated that 6 million Americans on the individual market, both on- and off-exchange, do not receive subsidies and have a median income of $75,000.

Covered California noted that in addition to restoring and increasing investments in marketing and outreach, there are other policies that could protect consumers from significant premium increases. They include funding a state-based reinsurance program and expanding the existing subsidy program to make coverage more affordable for consumers.

Covered California sent the analysis, along with a letter detailing Covered California�s observations and experiences, to Secretary Alex Azar of the U.S. Department of Health and Human Services and Administrator Seema Verma of the Centers for Medicare and Medicaid Services.

View a copy of the letter: https://www.coveredca.com/news/pdfs/04-25-18-CoveredCA-AzarVermaLetter.pdf.

Read the full analysis: http://hbex.coveredca.com/data-research/library/CoveredCA_2018_Individual_Market_Enrollment_4-25-18.pdf.

About Covered California

Covered California is the state�s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California�s consumers. It is overseen by a five-member board appointed by the governor and the Legislature. For more information about Covered California, please visit www.CoveredCA.com.